Section 11 of the IBC states that certain persons are not entitled to make applications for initiating a CORPORATE INSOLVENCY RESOLUTION PROCESS. These are:

(a) a CORPORATE DEBTOR already undergoing a CORPORATE INSOLVENCY RESOLUTION PROCESS;

(b) a CORPORATE DEBTOR that has completed a CORPORATE INSOLVENCY RESOLUTION PROCESS in the 12 months preceding the date of filing the application;

(c) a CORPORATE DEBTOR or an FC which has violated any of the terms of the resolution plan that was approved in the 12 months before the date of filing the application for a CORPORATE INSOLVENCY RESOLUTION PROCESS;

(d) a CORPORATE DEBTOR in respect of whom a liquidation order has been made.

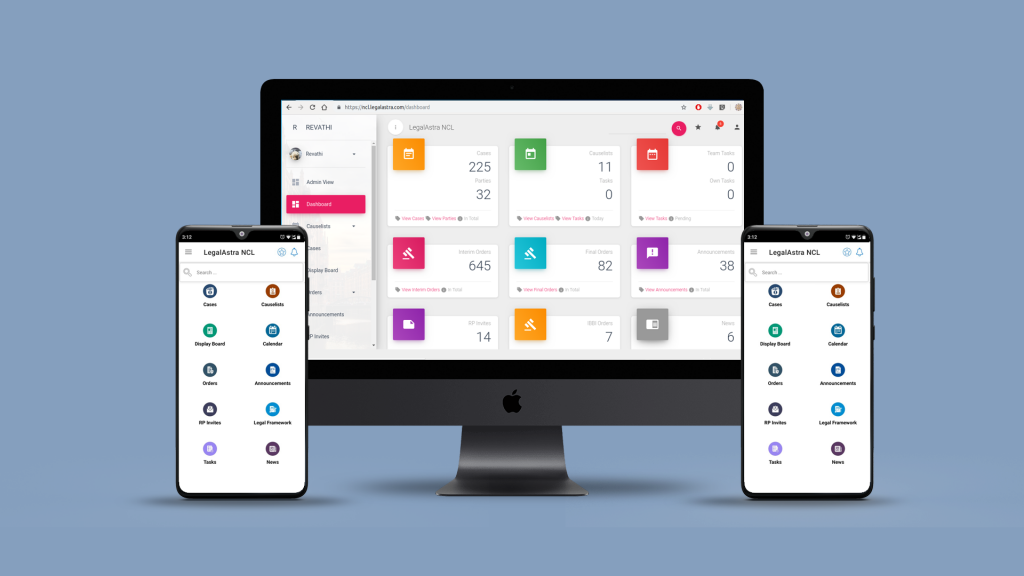

Track your NCLT / NCLAT cases or orders in your apple iOS / Google Android smartphones. Available for free trial period of 15 days.

Where a winding-up petition is pending against a CD, both an FC and an OC as well as the corporate applicant are free to file an application to initiate the CIRP even if notice has been given in the winding-up petition by the relevant High Court. As the IBC overrides every other insolvency and bankruptcy law in existence, a CD cannot raise any objection about the effect of a petition filed under section 7 on the grounds that a petition or petitions were already pending against it in a High Court.

In Forech India Limited Vs. Edelweiss Assets Reconstruction Co. Limited the Supreme Court held that section 11(d) of the IBC is of limited application and only bars a CD in respect of whom a liquidation order has been made from filing an application under section 10 of the IBC. However, an FC application is an independent proceeding that must be decided in accordance with the IBC