An INFORMATION UTILITY is defined in section 3(21) of the IBC as a “person” registered as such with the IBBI under section 210. The primary function of INFORMATION UTILITYs is to provide high quality authenticated information about debts and defaults, making them important from a public policy standpoint. Section 209 of the IBC specifies that no INFORMATION UTILITY can do business under the IBC unless it has a certificate of registration from the IBBI. The certificate, once granted, is valid for five years from the date of issue. The role of INFORMATION UTILITYs in an insolvency proceeding depends on the information on debts and defaults the INFORMATION UTILITY possesses, the validity of information as evidence, and the use of this information in the insolvency procedure.

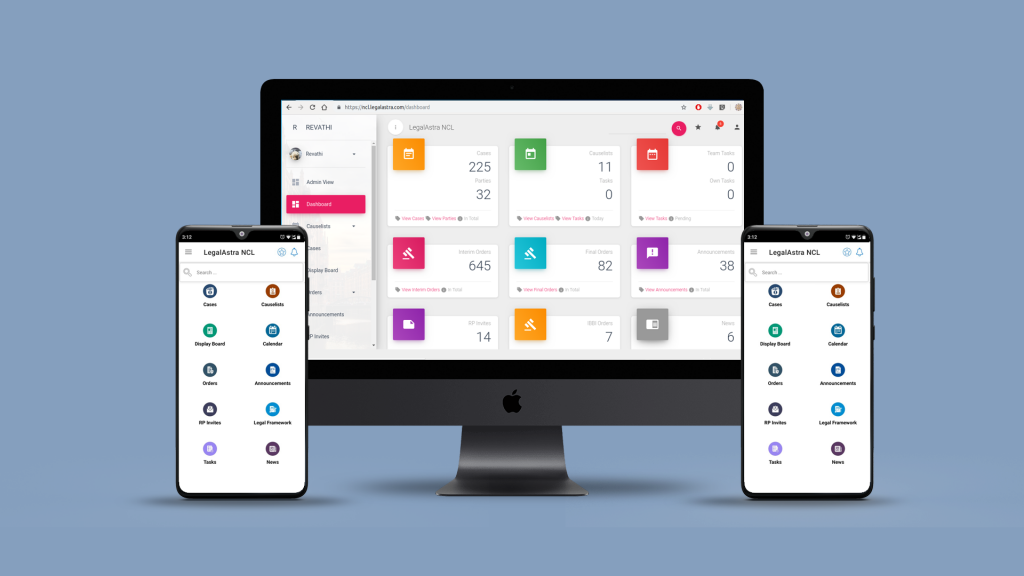

Track your NCLT / NCLAT cases or orders in your apple iOS / Google Android smartphones. Available for free trial period of 15 days.

Courts and tribunals should accept the electronic records of INFORMATION UTILITYs as admissible evidence. Section 7(4) of the IBC attributes evidentiary value to the information held by INFORMATION UTILITYs, as the Adjudicating authority is required to ascertain the occurrence of a default in the payment of a financial debt within 14 days of receiving an application filed by a financial creditor (FC) under section 7(2), from, among other sources, the records stored with an INFORMATION UTILITY. It can also use other evidence furnished by the FC.

For INFORMATION UTILITY records to be accepted as evidence, the information stored must be reliable. The INFORMATION UTILITY thus has the work of authenticating the information. Sections 3(9) (c) and 214(e) of the IBC state that once information is submitted to an INFORMATION UTILITY, it must authenticate it with all concerned parties and only then store it in its records.